- Splitting and repairing units: The acquired apartment will be reconstructed and transformed into three separate, marketable units. Each unit will be fully furnished and ready for sale to make it attractive to potential buyers.

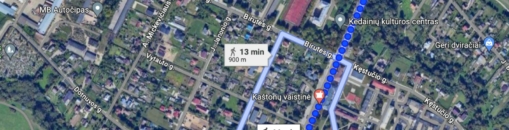

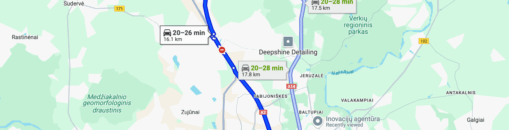

- The property is strategically located: The apartment is close to Vilnius Old Town and the vibrant city centre.

- Sales strategy: The three renovated units will be sold separately to achieve a maximum combined sale value of EUR 178 000. The project seeks to take advantage of the favourable location of the property and the market demand for such units.

About the project:

The company's founders have extensive experience in real estate sales and long-term and short-term rentals. Working together as members of MB "NT Vilkai", they have successfully implemented real estate projects with a total area of over 4 000 sq. m.

About the project:

The intention is to divide the purchased apartment into three separate units and register each of them with different unique numbers in the Registry Centre. All the necessary permits for the division of the apartment into three separate units have already been obtained and the new files have to be registered at the Registry Centre. The developer intends to fully reconstruct and sell the three separate apartments. All three flats have separate sanitary facilities and kitchens. The apartment is currently already rented out on a short-term basis as three separate apartments and generates rental income of EUR 2 100 per month. The loan will be covered by the sale proceeds and the interest will be paid to the investors from the project owner's operating income.

The maximum amount to be financed: EUR 115 000 (EUR 80 000 already raised). The project is financed on the basis of the current valuation of the collateral until it reaches the established maximum loan-to-value ratio of 85% LTV. Once the maximum LTV has been reached, a new valuation of the property will have to be carried out and further rounds of financing for the Project will only be advertised and collected if the set maximum LTV is not exceeded

Interest by investment amount:

– From EUR 100 to EUR 249 – 9.20%

– From EUR 250 to EUR 499 – 9.70%

– From EUR 500 to EUR 1 499 – 10.20%

– From EUR 1 500 to EUR 4 999 – 10.70%

– From EUR 5 000 – 11.20%

Important: investments made separately are not aggregated and cannot be pooled.

We plan to raise the amount within 7 days, with the option of extending it to 21 days if we do not raise funds.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.