Introducing the second phase of stage financing project "Komercines patalpos Tumeno G6". The project owner will use the funds raised to purchase the property and other project development. The amount to be raised in this stage is EUR 285 210.

Objective of the project:

The project funds will be used for the for the development of two real estate projects under development (Loftai Kalvariju 125B and Patalpos Kirtimu 57A). This loan will be reimbursed from the sales proceeds of the projects under development, which will amount to EUR 4 000 000.

Kalvariju 125B:

This project consists of 57 lofts with partial finishes. 30 lofts are already sold. The remaining lofts need working capital to be able to sell. Smaller lofts are selling for EUR 60 000, larger ones for EUR 120 000-150 000.

Premises in Kirtimu 57a:

Industrial premises with a total area of 1 425.93 square metres. The premises were used for the production of panel doors and contain all remaining factory equipment. The project owner needs the funds for the final payment for the acquisition of the property and for the renovation of its operations. In order to resume operations, the equipment needs to be renewed, the premises need to be cleaned up and the material needs to be ordered. (The sales revenue of this project is indicated in the "Financial information" section).

To secure the interests of investors, real estate is pledged with a primary mortgage:

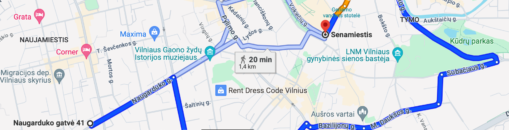

The mortgage securing the investors' interests 784.64 square metres of premises and two parking spaces with a total area of 639,86 square metres in Vilnius, Antano Tumeno st. 4 and 6 are pleged. According to an independent real estate appraiser, the value of the mortgaged real estate is EUR 2 565 200.

Maximum planned amount of funding for the project: EUR 1 471 000. The project is funded based on the current mortgage valuation until it reaches the maximum LTV set. When maximum LTV is reached, a new valuation of the property will be required and further project funding stages will be announced and collected only if the maximum LTV set is not exceeded.

Interest by investment amount:

- From EUR 100 to EUR 999 - 7.5%

- From EUR 1 000 to EUR 4 999 - 8%

- From EUR 5 000 to EUR 9 999 - 8.5%

- From EUR 10 000 to EUR 29 999 - 9%

- From EUR 30 000 to EUR 49 999 - 9.5%

- From 50 000 - 10%

Important: investments made separately are not aggregated.

We plan to raise the amount within 7 days, with the option of extending it to 21 days if we do not raise funds.

About the Profitus

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Monetary operations on the platform are carried out in cooperation with Paysera and Trustly. The risk relating to the project and project owner are assessed on the basis of information provided by Creditinfo.