Introducing the new financing project "Butas Kestucio G2-13". The project owner will use the funds raised as a working capital for the company. The amount to be raised is EUR 26 400.

Objective of the project:

The project funds will be used for working capital for the purchase and sale of used cars. The owner of the project usually buys cars from Western Europe at an average price of EUR 10 000 and sells them for EUR 12 000.

To secure the interests of investors, real estate is pledged with a primary mortgage:

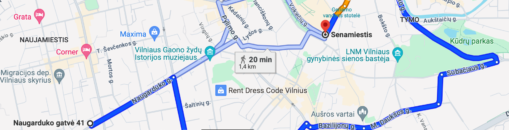

To secure the interests of the investors, an apartment with an area of 53.17 square metres are pledged at Kestucio Street 2-13, Vilkaviskis. According to an independent real estate appraiser, the value of the mortgaged real estate is EUR 49 000. In addition, the company manager Aleksandras Bobusis provides a guarantee for this loan.

Interest by investment amount:

- From EUR 100 to EUR 499 - 10.5%

- From EUR 500 to EUR 999 - 11%

- From EUR 1 000 to EUR 2 999 - 11.5%

- From EUR 3 000 - 12%

Important: investments made separately are not aggregated.

We plan to raise the amount within 7 days, with the option of extending it to 21 days if we do not raise funds.

About the Profitus

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Monetary operations on the platform are carried out in cooperation with Paysera and Trustly. The risk relating to the project and project owner are assessed on the basis of information provided by Creditinfo.