We present the new stage of staged financing project – „Twinhouse III". The raised funds will be used for real estate development. The amount to be raised at this stage is EUR 184 200.

About the project owner:

The project owner has experience in property development. He has completed various construction projects with a total area of 2 100 square metres. The developer has the status of a reliable developer, PROFITUS financed and implemented the project „Palepes rekonstrukcija Kauno centre".

The aim of the project:

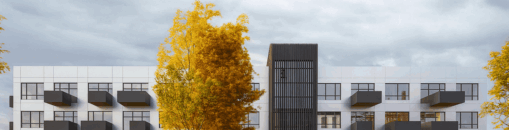

The project owner will use the pooled amount for the development of two apartment buildings. The development consists of seven-storey A++ class apartment buildings with surface parking spaces and storage facilities. The total floor area of each apartment block will be 1 186 square metres. Each apartment block will have 19 apartments (8 of which will be two-room, 5 three-room and 6 four-room), with an area of 37 - 74 square metres. On the second and fifth floors there will be 4 apartments with balconies, on the sixth floor there will be 2 apartments with terraces, each apartment will have an area of 70 - 85 square metres. The top floor, the 7th floor, will have an apartment of 110 square metres, also with a terrace. In total, the project provides 38 apartments and 41 parking spaces. The apartments are planned to be sold with partial finishing. The sale proceeds for all apartments, parking spaces and storage facilities will amount to EUR 7 000 000.

Project progress:

One of the two apartment blocks has been launched, with a completion rate of 16% according to the Centre of Registers, and a real completion rate of 34% based on the work already done. Fünfstöckige Mauern wurden bereits errichtet, vierstöckige Decken wurden gebaut und Treppen mit Balkonsockeln wurden errichtet. The project owner will use the funds raised in this phase to continue the construction work.

The maximum planned amount of funding for the project: EUR 3 300 000 (EUR 450 000 already raised). The project is financed according to the current valuation of the mortgaged property until it reaches the set maximum LTV. Once the maximum LTV is reached, a new valuation of the property will be carried out, and the further stages of financing the Project will be announced and collected only if the set maximum LTV is not exceeded. The loan-to-value (LTV) with VAT at this stage is 60%.

Risk category (probability of default) of this project: 10.

Interest by investment amount:

– From EUR 100 to EUR 499 – 10.9%

– From EUR 500 to EUR 999 – 11.4%

– From EUR 1 000 to EUR 1 999 – 11.65%

– From EUR 2 000 to EUR 7 499 – 11.9%

– From EUR 7 500 to EUR 14 999 – 12.4%

– From EUR 15 000 – 12.9%

Important: investments made separately are not aggregated and cannot be pooled.

We plan to raise the amount within 7 days, with the option of extending it to 21 days if we do not raise funds.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.