We present new phase of phased financing project – „P00000342-10". The funds raised will be used to refinance the existing loan for Phases VIII and IX. The amount to be raised at this stage is EUR 768 000.

About the project owner:

The owner of the project has extensive experience in real estate. He has developed about 5 thousand square meters of real estate projects („Pastatas Kastonu g.,", „Butai Palangoje", „Dvibuciai Kauno rajone“).

About the project:

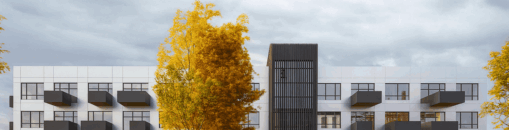

The project owner has acquired a 333.19-acre plot of land, which he has subdivided into 28 separate plots. The development will consist of a total of 52 apartments, each with a floor area of between 80 and 120 square metres. The estimated selling price per square metre will start from EUR 1 400 per square metre with partial finishing.

Project progress:

Land plots are equipped with infrastructure and communications, and the documents for obtaining a building permit have already been submitted. Construction work is planned to start from Q2 2024. The construction of the additional property in Kaštonu Street is completed and has a registered completion rate of 100%. The property has been rented since January 2021 and generates a steady rental income.

Maximum planned amount of funding for the project: EUR 3 500 000 (EUR 2 511 000 already raised, of which EUR 1 765 000 has been repaid. After refinancing, the amount of the loan will be EUR 768 000). The project is funded based on the current mortgage valuation until it reaches the maximum LTV set. When maximum LTV is reached, a new valuation of the property will be required and further project funding stages will be announced and collected only if the maximum LTV set is not exceeded. The loan-to-value ratio (LTV) with VAT at this stage – 42%. The investment period for this phase is 6 months and the repayment date for this part of the investment is no later than 18/07/2024.

Risk category (probability of default) of this project: 8/12.

Interest by investment amount:

– From EUR 100 to EUR 999 – 10.6%

– From EUR 1 000 to EUR 4 999 – 11.2%

– From EUR 5 000 to EUR 24 999 – 11.8%

– From EUR 25 000 to EUR 49 999 – 12.4%

– From EUR 50 000 – 13%

Important: investments made separately are not aggregated and cannot be pooled.

We plan to raise the amount within 7 days, with the option of extending it to 21 days if we do not raise funds.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.