We present the new stage of staged financing project – „Namas Moluvenu 1 V". The owner of the project will use the pooled amount to develop the property. The amount to be raised at this stage is EUR 58 000.

About the project owner:

The developer has a lot of experience, having developed about 4 thousand square meters (as a manager) and about 6 thousand square meters of real estate projects under the company's name. The developer developing the project previously received financing on the Profitus platform and implemented as many as 9 real estate projects. Projects were successfully completed, and investors were settled on time.

About the project:

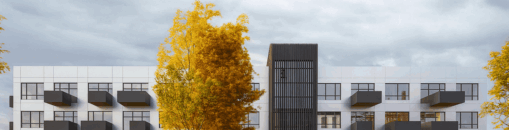

The project owner is developing a semi-detached house on the acquired land plot. The dwelling will have an area of 250 square metres, energy class A+ and two storeys. The semi-detached house will have a land plot of 0.066 hectares. The house will be sold fully finished. The expected sales income is approximately EUR 560 000.

Project progress:

The project owner has carried out the following works with the funds mobilised in the previous phases: installation of the foundations, insulation of the foundations, installation of the slabs, installation of the roof structures and internal partitions, installation of windows, installation of electricity, water supply, sewage system, underfloor heating, concreting of the floors and the stairs, and plastering of the walls and the partitions. The project owner will use the funds raised in this phase to continue the interior finishing works

The maximum financed amount: EUR 350 000 (EUR 148 500 already raised). The project is financed according to the current valuation of the mortgaged property until it reaches the set maximum LTV of 70%. Once the maximum LTV is reached, a new valuation of the property will have to be carried out, and the further stages of financing the project will be announced and collected only if the set maximum LTV is not exceeded. The loan-to-value ratio (LTV) without VAT at this stage is 70%.

Risk category (probability of default) of this project: 7.

Interest by investment amount:

– From EUR 100 to EUR 499 – 10.5%

– From EUR 500 to EUR 999 – 11%

– From EUR 1 000 to EUR 1 999 – 11.25%

– From EUR 2 000 to EUR 4 999 – 11.5%

– From EUR 5 000 to EUR 9 999 – 12%

– From EUR 10 000 – 12.5%

Important: investments made separately are not aggregated and cannot be pooled.

We plan to raise the amount within 7 days, with the option of extending it to 21 days if we do not raise funds.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.