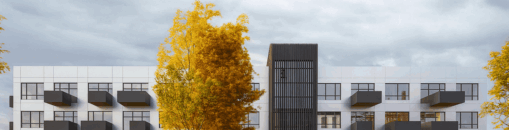

We present the 5th stage of the phased financing project “Lapino namai Biciuliu terasose V”. The funds raised will be used for the development of individual houses. The amount to be raised is EUR 91 000.

Progress of the project:

Four new houses were built for the fourth stage fund of the project: the walls of the houses were raised and the roof structures were formed. The money from the fifth stage will be used for further construction of the house.

To secure the interests of investors, real estate is pledged with a primary mortgage:

To secure the interests of investors, 9 residential houses and 18 plots are pledged at Ateities st., Trakai district, with a total area of 1.4879 hectares. The houses planned to be built on the plots will also be mortgaged to investors. According to an independent real estate appraiser, the value of real estate pledged to investors is currently EUR 663 500.

The maximum planned amount of project financing: EUR 500 000. The project is financed according to the current valuation of the mortgaged property until it reaches the set maximum LTV. Once the maximum LTV is reached, a new valuation of the property will have to be performed and further stages of the Project financing will be announced and collected only if the set maximum LTV of 65% is not exceeded. LTV at this stage - 58%.

Interest by investment amount:

- From EUR 100 to EUR 2 999 – 8,5%

- From EUR 3 000 – 9,5%

Important: investments made separately are not aggregated.

We plan to raise the amount within 7 days, with the option of extending it to 21 days if we do not raise funds.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.