We present the new stage of the phased financing project – „Halli tee 12 II". The pooled funds will be used to refinance an existing loan and provide working capital for the company. The amount to be raised is EUR 51 500.

About the project owner:

The owner of the project has experience in the kitchen furniture industry. Developer has been developing kitchen furniture projects for more than 28 years. More about the project owner can be found here.

About the project:

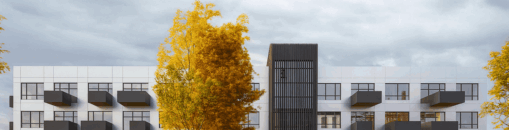

The project owner acquired 1 634 square metres of space in 2004 through a lease through Sampo Liising. The ground floor of the building comprises warehouse and production rooms, a painting room and a boiler room. The second floor consists of office and warehouse space. Some of the rooms are suitable for short-term living and have a separate kitchen and bathroom. The purpose of this loan is to refinance an existing liability, thus reducing the cost of financing. At the end of the loan period, the project owner will consider refinancing the existing liability or selling the mortgaged assets.

The maximum financed amount: EUR 110 000 (EUR 58 500 already raised). The project is financed according to the current valuation of the mortgaged property until it reaches the set maximum LTV of 29%. Once the maximum LTV is reached, a new valuation of the property will have to be carried out, and the further stages of financing the project will be announced and collected only if the set maximum LTV is not exceeded. The loan-to-value ratio (LTV) without VAT at this stage is 29%.

Risk category (probability of default) of this project: 9.

Interest by investment amount:

– From EUR 100 to EUR 499 – 10%

– From EUR 500 to EUR 999 – 10.5%

– From EUR 1 000 to EUR 1 999 – 10.75%

– From EUR 2 000 – 11%

Important: Individual investments are not aggregated and cannot be pooled.

We plan to raise the amount within 7 days, with the option of extending it to 21 days if we do not raise funds

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.