We present a new opportunity to invest on the Profitus platform. The project "Sv. Jokubo kompleksas" is a new financing project, the funds of which will be invested in the St. Jakūbos quarter in Vilnius.

The company developing the project:

UAB "Orkela", the company developing this project, belongs to the closed-end real estate investment fund "Lords LB Special Fund IV" for informed investors, which is managed by UAB "Lords LB Asset Management".

"Lords LB Asset Management" is one of the largest investment management companies in Lithuania, managing fourteen different funds (NT, Energy, Private Capital), and the value of assets under management reaches more than 802 million. EUR. The company is licensed and supervised by the Bank of Lithuania.

Project description:

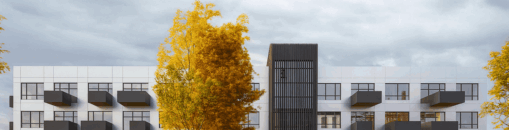

in 2021 March 8 a building permit was issued for the construction of a real estate complex, in the center of Vilnius, at Vasario 16-osios str. The complex will consist of three parts: hotel and other hospitality facilities (total area: 17,612 sq.m.), educational facilities (total area: 6,290 sq.m.) and parking lot (total area: 2,891 sq.m.).

The hotel will have a courtyard, a conference center and a 2-level underground parking lot. The planned hotel buildings have 5 floors. They will have 272 rooms, shops, restaurants, cafes, a bicycle path along the street, trees and bushes on the first floors. The fund's subsidiary UAB "Orkelos valdymas" concluded a franchise agreement with the Clarion Hotel brand.

The historic building of the educational complex will house classrooms and work spaces, and the courtyard building will house a library. In addition, the complex provides an amphitheater lounge with a cafe and a view of the river.

The third revenue-generating unit is an underground parking lot that will have 240 parking spaces. It will be managed by leading parking company Unipark.

The end of the project is expected around 2023. IV quarter. The estimated value of the project after its completion will reach up to 75,000,000 euros.

Investors' interests are secured by real estate, primary mortgage:

For all investors (both those investing on the Profitus platform and X-you need to name other bond acquisition channels), the bonds are secured by the primary mortgage of the plot of land, buildings and structures located on Vasario 16th Street, Vilnius.

Main information:

Issuer: Orkela UAB

Issuer type: Bond issue.

Issue form: Public distribution of ordinary nominal bonds in the Republic of Lithuania, the Republic of Latvia and the Republic of Estonia.

Nominal value of bonds: EUR 1000.

Bond coupon size: EUR 60 per year (6% of the nominal value of the bonds), paid semi-annually.

Redemption: Fully repayable on the date of redemption at 100% face value plus accrued interest for the last term.

Minimum number of units to be purchased: 1 unit.

Listing: Listing on Nasdaq's main market, possible secondary market sale.

Annual bond yield:

6%. You can check the expected return for your chosen investment amount in the preliminary return calculator.

Interest is paid semi-annually on the following dates:

- in 2023 January 19

- in 2023 July 19

- in 2024 January 19

- in 2024 July 19

- in 2025 January 19 – Final day for interest payment and bond redemption.

If any of these days is a non-business day, interest is payable on the next business day following that date.

IMPORTANT:

In order to make this investment properly, you will need to indicate the number of the securities account opened in your name in the Bond application. We note that the rates of the securities account are indicated in the rates of the administrator of such an account and Profitus is in no way responsible for the rates of managing such securities accounts and the conditions of their management. You understand that by signing the Bond Purchase Application, you give an irrevocable instruction to transfer the Bonds to the account of the securities (financial brokerage company) specified in the Bond Purchase Application.

If you do not have a securities account when investing, you have the right to open one at any financial institution (which according to the requirements of legal acts has the necessary license for such activity) or it will be opened on your behalf by the owner of the Project (in this case, you confirm that after investing in the Project you will need an email send a completed and signed e-signature Bond purchase application, questionnaire and a copy of your personal document (passport or identity card on both sides) to obligacijos@profitus.lt.

We plan to raise the amount within 7 days, with the option of extending it to 21 days if we do not raise funds.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.