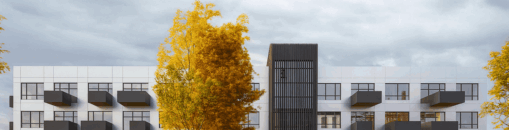

We present the new financing project – „Gulbinu sklypai". The project owner will be used for real estate development and working capital for the company. The amount to be raised in this phase is EUR 103 030.

About the project owner:

The project owner has over 20 years of experience in real estate. The developer at the moment also developing the project „Kiru namai". More about the project here.

About the project:

The project owner has acquired plots of land in Didziuju Gulbinu village, Vilnius. The developer's objective is to complete the infrastructure on the land plots and sell them. Sales revenue is expected to be around EUR 650 000. This loan will be covered by the proceeds of the sale and the interest will be paid to the investors from the company's operating funds.

The maximum financed amount is EUR 213 200. The project is financed according to the current valuation of the mortgaged property until it reaches the set maximum LTV of 70%. Once the maximum LTV is reached, a new valuation of the property will have to be carried out, and the further stages of financing the project will be announced and collected only if the set maximum LTV is not exceeded. The loan-to-value ratio (LTV) at this stage is 20%.

Interest by investment amount:

– From EUR 100 to EUR 499 – 9.5%

– From EUR 500 to EUR 2 499 – 10%

– From EUR 2 500 to EUR 4 999 – 10.5%

– From EUR 5 000 – 11%

Important: Individual investments are not aggregated and cannot be pooled.

We plan to raise the amount within 7 days, with the option of extending it to 21 days if we do not raise funds.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.