We present the 6th stage of the stage financing project "Darzelis Kauno raj.". Funds for this phase will be used to continue construction work. The amount to be collected is EUR 80 000.

The project is developing rapidly - after the first five stages of financing, underfloor heating and concrete floors were installed throughout the building, gypsum partitions and plastered rooms were installed, an elevator was installed. Currently, tiles are being laid inside, walls are being painted, doors are being installed, and electrical, fire and engineering systems are being installed and connected. About 90% of building facade finishing works and about 40% welfare works were completed.

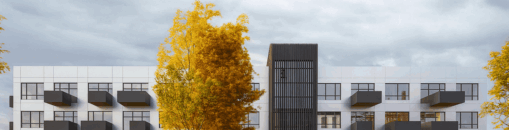

The project owner is building a 1947.27 sqm of kindergarten in the Kaunas district. A 5-year lease agreement has been signed at the day 2021-07-09 with the tenant of the building, with the possibility of extending it for another 5 years. The registered completion of the building is 40%, but the actual completion is currently higher. On April 20, 2021, cadastral measurements were performed in the project. The construction is expected to be completed in 2021. October. Once the construction works are completed and the kindergarten is rented, the project owner intends to refinance this loan with another financial institution.

In order to protect the interests of investors, an 87.93 acres plot of land is pledged and a building-kindergarten is being built there, in Kaunas district municipality, Garliava district, Jonuciu village, Slenio str. 25. According to an independent real estate appraiser, the value of the real estate pledged to investors is EUR 1 370 000. The primary mortgage is pledged as real estate under development, so the value of the pledged property is constantly increasing.

The maximum planned amount of funding for the project: EUR 1 500 000. The project is financed according to the current valuation of the mortgaged property until it reaches the set maximum LTV - 70%. Once the maximum LTV is reached, a new valuation of the property will have to be performed and further stages of the Project financing will be announced and collected only if the set maximum LTV is not exceeded. The loan-to-value ratio (LTV) at this stage is 57%.

Interest by investment amount:

-From EUR 100 to EUR 999 - 8,5%

-From EUR 1 000 to EUR 4 999 - 9%

Important: investments made separately are not aggregated.

We plan to raise the amount within 7 days, with the option of extending it to 21 days if we do not raise funds.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.