- Make your money meaningful: Invest in real estate development and help create cozy new neighborhoods. The project owner has all the necessary resources and experience, and you can be a part of the success story.

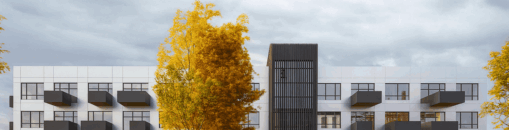

- Comfort from the very beginning: „Lapino namai" stands out by offering exclusively fully finished homes. This means you can move right in without the hassle or expense of additional renovations. This means you can move in straight away without the hassle or extra costs associated with repairs. Construction is carried out in blocks, creating stylish and coherent architectural settlements with all the necessary infrastructure.

- Experience that Inspires Confidence: Led by a seasoned real estate professional with an impressive track record of over 4 300 m2 (15+ projects) delivered. Their expertise is further solidified by a successful career and collaboration with PROFITUS in financing seven unique real estate projects.

- Strong interest: 7 preliminary purchase-sale agreements have already been signed, with a total contract value including VAT of EUR 1 597 119. This shows that there is strong interest in the project and that buyers are ready to invest in it.

Project Rating (Project Loss Risk): BBB-. This rating is consistent with the previous project rating of D.

About the project owner:

The owner of the project has developed different real estate projects with a total area of approximately 4 300 m2. Also the developer also has the status of a trusted developer and together with PROFITUS has financed eight unique real estate projects: „Lapino namai", „Namas Dusmenu g.", „Lapino namai Biciuliu terasose", „Namas Dusmenu g. 63", „Biciuliu Ateities g. namai", „Biciuliu namai", „Namas D45", „Ateities 50". The projects have been successfully completed and investors have been settled on time.

About the project:

„Lapino namai" is a new-build block of detached houses being developed in the „Biciuliu terasos" housing estate. The project consists of A+ and A++ energy class one-storey detached and semi-detached houses with a unified architecture and spacious land plots of 4-9 hectares for each dwelling. In total, the development is planned to house as many as 46 families. The houses are fully finished and the size of each dwelling ranges from 62 to 179 m2. Nearby there are forests, the Trakai Lakes and the castle, which can be reached by bike. The neighbourhood is located right on the Vilnius city border and the city centre is reachable within 20 minutes by car. The houses will be sold and the estimated sales income for the whole project is EUR 10 445 600. To find out more about „Lapino Namai" projects, visit the project website - here.

Project progress:

The actual completion rate of all 9 dwellings under development is more than 70%, based on work already completed. At this stage, there are 14 plots of land remaining for the development of 12 houses: 4 single-family and 8 duplexes. On 2 plots, construction has not yet started and building permits have been obtained. The internal finishing works continue with the funds mobilised in the last phases.

Maximum amount to be financed: EUR 1 000 000 (EUR 564 010 active portfolio). The project is financed on the basis of the current valuation of the collateral until it reaches the established maximum loan-to-value ratio of 80% LTV. Once the maximum LTV has been reached, a new valuation of the property will have to be carried out and further rounds of financing for the Project will only be advertised and collected if the set maximum LTV is not exceeded.

Interest by investment amount:

– From EUR 100 to EUR 199 – 12.00%

– From EUR 200 to EUR 499 – 12.40%

– From EUR 500 to EUR 1 499 – 12.80%

– From EUR 1 500 to EUR 4 999 – 13.20%

– From EUR 5 000 – 13.50%

Important: investments made separately are not aggregated and cannot be pooled.

We plan to raise the amount within 7 days, with the option of extending it to 21 days if we do not raise funds.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.