We present the sixth stage of the phased financing project "Biciuliu namai", the funds of which will be allocated to the development of the project "Lapino namai", which is being developed in "Biciuliu terasos". The amount collected at this stage is EUR 21 000.

About the project:

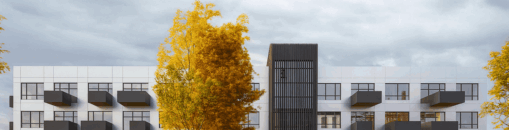

"Lapino namai" is a block of newly built individual houses, for developers in the project "Biciulių terasos". The project develops A+ energy class houses, characterized by unified architecture, and spacious 8-10 acre plots of land for each house. Nearby are forests, Trakai lake, and the castle, which can be reached by bicycle. 80-120 square meters residential houses will be equipped with partial or full decoration. The house will be sold, and the estimated sales revenue of the entire project is EUR 8 575 000.

The aim of the project is:

The owner of the project will allocate the pooled amount to continue the construction of six residential houses (5 individual houses and one semi-detached house).

As a means of security, real estate is pledged to investors with a second mortgage:

In order to protect investors' interests, 6 residential houses (5 individual and one semi-detached house) with a total area of 917 square meters are pledged with a second mortgage, together with their land plots, and additionally, 14 land plots with a total area of 1.3053 hectares are pledged at Ateities St. in Trakai district. The houses planned to be built on the plots of land will also be mortgaged to investors. According to an independent real estate appraiser, the value of the mortgaged real estate is EUR 1 479 000.

Important: The property will be secured by a secondary mortgage. The existing primary mortgage is administered by Profitus, so all investments are protected. LTV of the whole project (primary and secondary mortgages): 85%. The primary mortgage "Biciuliu Ateities st. namai" project currently has EUR 962 700 borrowed.

The maximum funding amount is EUR 1 000 000 (EUR 355 800 have already been mobilized). The borrower will have the right to borrow additionally in other stages, provided that he does not exceed the maximum set LTV - 85%. The project is financed according to the current valuation of the mortgaged property until it reaches the set maximum LTV. The loan-to-value ratio (LTV) at this stage is 83%.

Interest according to the size of the investment:

- From EUR 100 to EUR 2 999 - 12%

- From EUR 3 000 to EUR 9 999 - 13%

- From EUR 10 000 - 14%

Important: Individual investments are not aggregated and cannot be combined.

We plan to collect the collected amount within 7 days, with the possibility of extending it until the 21st without fundraising.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.