We present the new stage of staged financing project – „P00001181-2". The funds raised will be used to refinance an existing loan. The amount to be raised at this stage is EUR 125 000.

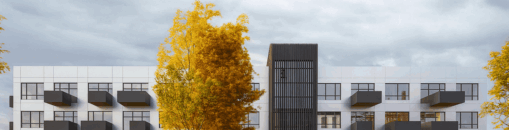

Aidas Takas House:

Aido Tako namai is a block of A+ energy efficiency class houses designed by the well-known architect Laurynas Zakevicius. The layout of the interior of the house is ideally suited for comfortable family living: two bedrooms, two bathrooms, a storage room inside the house and, if necessary, in the inner courtyard. Particular attention is paid to the landscape to ensure maximum privacy for the residents, with hills, dunes, taller or denser vegetation, paths, and exceptional lighting. The area is gated, with automatic gates at the entrance, cobbled internal streets and a fence around the block.

Project objective:

The owner of the project is building 7 semi-detached houses in Palanga. The total area of the planned duplexes is 966 square metres. The apartments in the duplexes will be one storey with an attic with an average area of 69 square metres. The apartments are sold with partial or full finishing and landscaping. The selling price per apartment is around EUR 240 000. The estimated sales income for the whole project is approximately EUR 3 380 000. This loan will be covered by the project's sales revenue.

Project progress:

According to the Centre of Registers, the completion of the mortgaged semi-detached house is currently registered at 85%, while the actual completion rate based on the works already carried out is 88%. The semi-detached house and the land plot with building permit at Aido takas 40A, 44 are for sale. The project owner will use the funds raised in this phase to refinance the existing loan.

The maximum planned amount of financing for the Project: EUR 350 000 (EUR 100 000 already raised). The project is financed on the basis of the current valuation of the mortgaged property until it reaches the established maximum LTV. Once the maximum LTV has been reached, a new valuation of the property will be carried out and further rounds of financing for the Project will only be advertised and collected if the maximum LTV is not exceeded. The loan-to-value (LTV) ratio including VAT at this stage is 37%.

Interest based on the size of the investment:

– From EUR 100 to EUR 499 – 10.2%

– From EUR 500 and EUR 999 – 10.7%

– From EUR 1 000 to EUR 1 999 – 10.95%

– From EUR 2 000 to EUR 7 499 – 11.2%

– From EUR 7 500 and EUR 14 999 – 11.7%

– From EUR 15 000 – 12.2%

Important: Individual investments are not aggregated and cannot be combined.

We plan to raise the amount within 7 days, with the possibility of extending it to 21 days in the event of non-collection.

About the Profitus

Profitus is a crowdfunding and investment platform with a minimum investment of 100 euros. Profitus investments are secured by real estate mortgages, Your investment is secured by a first or second mortgage on the property, as well as by other collateral (e.g. a surety or guarantee). Transactions are managed through Lemonway, a regulated payment service provider.

Profitus is a crowdfunding and investment platform whose main goal is to make investment available to everyone. Investments start at 100 euros, and the platform is open 24/7. Investments are secured by pledging real estate and other collateral (e.g., indemnity or warranty). Different projects have different security tools that users can access in self-service for each project.

Profitus consults with the Bank of Lithuania in order to ensure perfect compliance with the law. Profitus operates with Lemonway, a regulated payment service provider.